Pvm Accounting Fundamentals Explained

Pvm Accounting Fundamentals Explained

Blog Article

Pvm Accounting Things To Know Before You Get This

Table of ContentsMore About Pvm AccountingPvm Accounting - An OverviewPvm Accounting Can Be Fun For EveryoneHow Pvm Accounting can Save You Time, Stress, and Money.Pvm Accounting Things To Know Before You BuyThe Basic Principles Of Pvm Accounting The 9-Minute Rule for Pvm Accounting

In terms of a firm's total strategy, the CFO is accountable for guiding the business to meet financial goals. Some of these techniques can include the company being acquired or acquisitions going forward.

As a company expands, bookkeepers can maximize a lot more team for various other business responsibilities. This can at some point cause boosted oversight, better accuracy, and much better compliance. With even more resources complying with the path of money, a service provider is a lot a lot more likely to earn money properly and in a timely manner. As a building and construction company expands, it will certainly require the aid of a full-time monetary personnel that's taken care of by a controller or a CFO to handle the firm's funds.

Pvm Accounting for Beginners

While huge services may have full-time financial backing teams, small-to-mid-sized businesses can employ part-time bookkeepers, accountants, or economic experts as required. Was this write-up helpful? 2 out of 2 people located this useful You elected. Adjustment your response. Yes No.

As the building and construction sector continues to flourish, businesses in this market must preserve strong economic monitoring. Efficient accountancy techniques can make a substantial difference in the success and growth of building firms. Let's check out 5 necessary bookkeeping techniques customized particularly for the building and construction sector. By implementing these techniques, building and construction organizations can boost their financial security, enhance procedures, and make educated choices - Clean-up bookkeeping.

Thorough estimates and budgets are the foundation of construction project monitoring. They help guide the job in the direction of prompt and profitable completion while protecting the rate of interests of all stakeholders entailed. The key inputs for job price estimate and spending plan are labor, products, equipment, and overhead expenses. This is generally one of the greatest expenses in building projects.

Little Known Facts About Pvm Accounting.

An exact estimate of materials required for a task will certainly assist make sure the needed products are bought in a prompt manner and in the right quantity. An error below can cause waste or delays due to material shortage. For many building projects, tools is needed, whether it is acquired or rented.

Appropriate tools estimate will help ensure the best tools is readily available at the right time, conserving money and time. Don't fail to remember to make up overhead expenditures when estimating project expenses. Straight overhead expenditures are particular to a project and might include short-lived leasings, energies, secure fencing, and water supplies. Indirect overhead expenditures are everyday costs of running your service, such as rental fee, management salaries, utilities, taxes, devaluation, and advertising and marketing.

Another variable that plays into whether a task achieves success is an exact quote of when the project will be completed and the associated timeline. This quote aids make sure that a job can be finished within the assigned time and sources. Without it, a task may lack funds before completion, causing potential work interruptions or desertion.

Facts About Pvm Accounting Uncovered

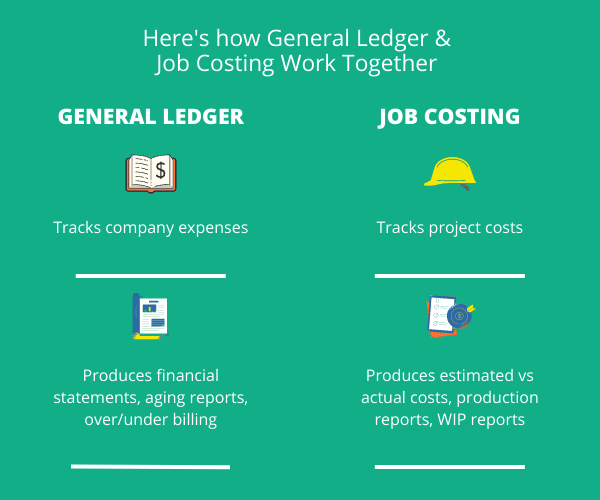

Precise job setting you back can aid you do the following: Understand the profitability (or lack thereof) of each job. As work costing breaks down each input right into a job, you can track productivity separately. Compare actual prices to estimates. Taking care of and assessing quotes enables you to better price tasks in the future.

By determining these items while the project is being finished, you stay clear of surprises at the end of the project and can attend to (and hopefully prevent) them in future tasks. A WIP routine can be completed monthly, quarterly, semi-annually, or every year, and includes task information such as agreement value, sets you back sustained to date, total approximated costs, and total task billings.

9 Easy Facts About Pvm Accounting Described

Budgeting and Projecting Tools Advanced software program provides why not try this out budgeting and projecting abilities, allowing building and construction companies to plan future projects much more accurately and manage their financial resources proactively. Paper Monitoring Construction projects involve a whole lot of documents.

Improved Supplier and Subcontractor Administration The software application can track and handle settlements to suppliers and subcontractors, ensuring prompt payments and preserving good connections. Tax Preparation and Declaring Audit software program can help in tax preparation and declaring, making certain that all relevant economic tasks are precisely reported and taxes are submitted on time.

What Does Pvm Accounting Do?

Our customer is an expanding development and construction firm with head office in Denver, Colorado. With several energetic construction tasks in Colorado, we are seeking a Bookkeeping Assistant to join our group. We are seeking a full-time Accountancy Aide that will certainly be accountable for providing useful assistance to the Controller.

Obtain and examine daily billings, subcontracts, modification orders, order, check demands, and/or other associated paperwork for efficiency and compliance with monetary policies, treatments, budget, and contractual demands. Precise handling of accounts payable. Get in invoices, authorized draws, order, and so on. Update regular monthly analysis and prepares budget pattern reports for building tasks.

Some Ideas on Pvm Accounting You Should Know

In this guide, we'll explore different facets of building bookkeeping, its value, the criterion tools made use of around, and its duty in construction tasks - https://www.goodreads.com/user/show/178444656-leonel-centeno. From monetary control and expense estimating to capital management, explore just how accounting can profit building jobs of all scales. Construction bookkeeping refers to the specialized system and procedures made use of to track financial information and make critical choices for building services

Report this page